Please always mark international trades as a gift!

PrincessxJasmine89

Active DPF Member

- Messages

- 2,440

- Location

- North East England, UK/DLR

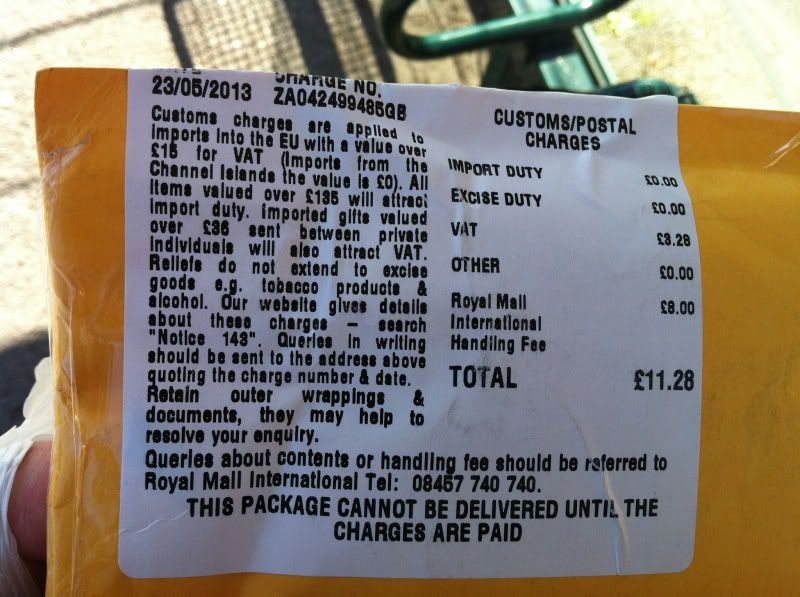

I really really really really really really really REALLY dislike customs fees, so outrageously high for holding a parcel for someone... really, now?! It's sad when your receive packages marked way over their value, or trades marked as merchandise... no money was involved so why mark it as anything other than a gift?

My fellow UK peeps, I feel your pain when we get slapped with a huge fee 🙁 It's always down to the sender's discretion whether they mark the true value or not on trades, but it would be nice if they'd help us out a little :lol: 🙂 <3

My fellow UK peeps, I feel your pain when we get slapped with a huge fee 🙁 It's always down to the sender's discretion whether they mark the true value or not on trades, but it would be nice if they'd help us out a little :lol: 🙂 <3