Having To Put My Pin Collection On Hold!

nsingleton

Jessica Rabbit Addict

- Messages

- 5,330

- Location

- Mishawaka, IN

Sorry to hear about that. Be careful.

Thank you!!!

Sorry to hear about that. Be careful.

I was thinking the same thing. I would definitely look into it.

And as for quitting, maybe take a little break like many are suggesting. The forum will be here when you're ready to come back :0)

Nate - who is going to foreclose? The bank that owns the mortgage? Why would the HOA manager tell you about this? No, you don't need to move out until they actually evict you (if you want to wait for that to happen, it would give you time to move out, etc.). You can always negotiate with the bank to leave quietly if they pay you and don't damage the property on your way out (similar to cash for keys). So, maybe you can recover some of that $2400 you paid the landlord with this arrangement.

Here are some helpful tips that I found with an internet:

http://www.ehow.com/facts_6144166_colorado-landlord_tenant-law.html

http://portal.hud.gov/hudportal/HUD?src=/states/colorado/renting/tenantrights

Do you have receipts which show that you made the payments to the landlord? What about your written lease? I know in CA, a foreclosure doesn't wipe out an existing lease.

Whatever you do, DON'T MOVE OUT (yet)!

BTW, I would also file a small claims action against the landlord for the return of your security deposit if you are forced to move out. You might be able to get a fee waiver and, sure, you might not be able to collect it, but in case the landlord is ever in a position of having funds, you might be able to get something 🙂

Hope everything looks up for you soon!

nsingleton said:Oh, I know, but it was a character I had not heard of and there was not a lot when I was looking to see the character, so I was enjoying the hunt, lol! And I like to do nice things for good people when I have the means!

Aww, well thank you. 🙂 Ezra has a few pins; but not as many as other characters. I think he's one of the more popular Haunted Mansion characters though.

I hope you can visit DLR one day, I'd love to visit myself as I've only been to WDW and DLRP. It would be amazing to go to the original park.

Thank you, I hope you get to as well!!! I would love to check out DLRP too, I have only been to WDW a few times, but no other locations! Someday!!!:wiggle:

More info I found (I did a search on "colorado eviction laws after foreclosure") and came up with this, an attorney's website:

See:

http://www.frascona.com/resource/war110_protecting_tenants_foreclosure_act_eviction.htm

Copying and pasting (the last half), it says:

If a tenant with a bona fide lease or tenancy occupies a foreclosed property, under the Act, the recipient of a PT Deed cannot start an eviction for a minimum of 90 days (assuming the tenant complies with the terms of the lease post-foreclosure). The Act will likely be interpreted to allow for this minimum 90 day notice to quit a property in only the following three situations:

So, if the property is going to be utilized as a primary residence, or if the tenant has a weekly or monthly rental or a lease set to expire sooner than 90 days, a tenant complying with the terms of a lease must receive a minimum 90 day notice to quit before an eviction action can be filed in court.

- The recipient of the PT Deed intends to occupy the property as a primary residence;

- The recipient of the PT Deed provides the required 90 day notice and then sells the property to someone who intends to occupy the property as a primary residence; or

- The tenant or occupant is without a lease or with a lease which can terminate in a shorter period of time under state law.

Of perhaps greater significance to the foreclosure investor is that if the above minimum 90 day notice criteria do not apply, the Act provides that the recipient of the PT Deed takes the property subject to the lease and the tenant gets to occupy the property for the remainder of the outstanding lease term. There is no language in the Act limiting this duration of time. So, if a tenant has a four year lease on a property and one year has passed as of the date of the foreclosure sale, unless one of the 90 day exceptions apply, the Act seems to provide that the tenant can remain in the property for the remaining three years of the lease.

While not explicit, the Act will likely be interpreted to permit eviction if a tenant fails to comply with the terms of the existing lease post-foreclosure. So, if a tenant fails to pay rent or fails to comply with any other covenant in a written lease, the recipient of the PT Deed can likely initiate the eviction process under Colorado law sooner than the time frames set out in the Act. The Act is also likely to be interpreted to permit any tenant to waive its rights and vacate the property after the foreclosure sale without any further obligations to the recipient of the PT Deed.

For foreclosure investors looking to take possession of a residential property occupied by a bona fide tenant in less than 90 days, “Cash for Keys“ is an option to consider.

The Act expires on December 31, 2012 unless Congress takes action to extend its effective date.

Okay, so you have a month-to-month tenancy that is paid up til September 2012 (I hope you have receipts, cancelled checks, something other than giving the landlord cash?). Is that correct? I sure hope so!

I am confused about the HOA Manager showing up to tell you that you need to move. Why should it be the HOA Manager's job to do that ? Did your landlord slack on the mortgage or on the HOA dues, or both? Did you research that to make sure?

Also, are you sure that the dude who presented himself as the HOA manager is really who he says he is? What if your landlord just sent someone to you so that you would move out w/o asking questions or causing trouble? I know these things sound crazy, but then again I have seen pretty nutty things too.

I am so glad that starry_solo did some digging on your behalf. See, you have friends on DPF 🙂

** Edit ** Is it possible that your landlord bought the unit from HOA and instead of the bank financed mortgage it was financed by the HOA?

Let's say that she is behind on her HOA dues too (besides on the mortgage). So, maybe the HOA wants to foreclose. Typically, the HOA doesn't have a lien senior to a first mortgage (but there could be different rules about that).

In any event, it looks like you're covered for at least 90 days after the foreclosure before the new owner can then file an unlawful detainer action. I am going to guess that if the housing situation in CO is similar to the one in CA, that no one will buy the property and it will revert back to the bank (that's assuming that the bank is the original lender).

If you don't earn a lot of money (really, you have to be at poverty level and if that's the case, you shouldn't be collecting pins), there has to be a Legal Aid services in Colorado Springs. See:

http://www.coloradolegalservices.org/lawhelp

and

http://www.coloradolegalservices.org/lawhelp/issues/housing/eviction

Maybe they can help

So sorry that happened to you :[

Wowzers! 🙁 You're really going through a tough time - looks like our Ohana has stepped up to assist though! 🙂

You know, the only good thing about tough times is that they pass - it's all an ebb and flow. Just hang on until the good times start to flow! 🙂 This too shall pass!

BTW, did you ever complain to the police about the person who sold you the car?

Wow. Hopefully they find something out (maybe it will be some part of some big car theft ring) and get some restitution.

Just hang in there and I hope all works out!

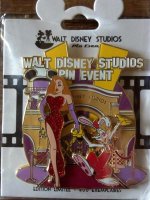

Am little more light shining through this darkness! Thanks a million to Mickeymousje! She sent me this AMAZING pin!!! I am so very grateful, brought another smile to my face!!!! I do not know how to fully express my gratitude! It really helps when I am not able to afford any pins right now! Debby and Greg, and now Mivkeymousje (don't know her actual name) are keeping my collection going! Thank you, it means SO much, no one can even understand! Anthoer GIGANTIC thank you!!!!

Am little more light shining through this darkness! Thanks a million to Mickeymousje! She sent me this AMAZING pin!!! I am so very grateful, brought another smile to my face!!!! I do not know how to fully express my gratitude! It really helps when I am not able to afford any pins right now! Debby and Greg, and now Mivkeymousje (don't know her actual name) are keeping my collection going! Thank you, it means SO much, no one can even understand! Anthoer GIGANTIC thank you!!!!